The forex market is unpredictable and requires excellent skills if you want to make a living from it. If you are a new trader, you will notice that the market always moves against the position you take, no matter what. You may spend hours analyzing the market or reading numerous resources on trading profitably, but you will still lose your money. The reason for the persistent loss is that the market is highly volatile and highly leveraged to result in persistent failure. However, by using Best Forex Signals, you stand a better chance of making consistent profits.

What are Forex Signals?

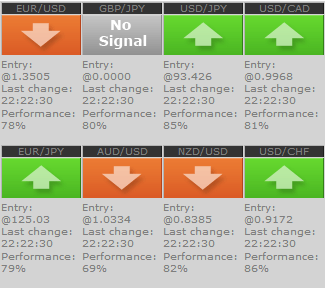

Forex Signals are suggestions generated using automated programs or after analysing the market manually. They can be free of charge, or paid. Typically, signals help a trader get started or learn how to trade forex, or help make some time off of a busy trader with other commitments in life. They help them develop some level of confidence in the provider, and most importantly, confidence in themselves. They simply outline the entry and the exit points.

They will help you to decide whether to buy or sell a currency, tell a trader when to open a position, and when to exit or close the positions. They also help a trader decide whether to take a long or short position. Also, they give the stop loss point just in case the price of a currency doesn’t move in the predicted direction.

These signals are only typically very useful if you can utilize them as soon as they are shared, regardless of how they are generated. If you use them too late, they may already be unreliable because the market conditions change rapidly, and different analyses may become invalid the longer the signal is not used from the time it was received. So, generally, it is best to enter the trade a few minutes after the signals are received from your provider.

How are they generated?

Technical Analysis

It is the most popular method of analyzing the market. It makes use of indicators that appear on a price chart. The analysis entails assessing the historical price activities, including looking at the previous resistance and support levels. It is a suitable and reliable method of identifying short-term price trends. Therefore, it is the most appropriate tool for traders that use short-term trading strategies such as scalping.

Fundamental Analysis

These are ideal tools for long-term investors. They determine the position to take based on the prevailing economic situation of a country. It uses inflation data, unemployment figures, and the volume of the goods manufactured to help predict the direction in which a country’s currency moves. The figures related to non-farm payroll data could also come in handy in determining whether a currency will be strengthening or weakening. In the United States, the figures show payments made to all employees other than the general government, nonprofit organizations, the farm, and household employees.

A Combination of Both

Both fundamental and technical analysis will yield information on the price at which a trader should get into the trade and the price they should exit. They assist a trader determine the take profit point to help the trader protect the earnings they have made. These are tools that study the market to predict how the price of a currency will move.

Algorithmic signals

Forex signals could be automated or manual. A professional trader may generate manual signals. At the same time, software programs generate the automated signals after analyzing the market using algorithms. They are products of robots that follow a given set of rules, programmed by experienced human traders, who have been into trading and/or investing for quite some time now. As such, there are algorithms for different trading strategies – swing trading, scalping, day trading, or mid to long term investing. Any trader, experienced or inexperienced, can buy and use these robots. Alternatively, you can register to a premium signal provider where you will have unlimited access to robot-generated forex signals.

Free or Paid?

If you are just starting out or new to the world of forex, it is generally better for you to have guidance in the form of the free signals, to help you “learn the ropes”, so to speak, and build your knowledge and confidence from there. Once you feel that you have enough of those two, then you can trade on your own, or try the paid/premium signals if you don’t have time to analyze the market anymore.

Final Thoughts

Signals can be considered the “shortcut” to learning forex trading – it’s just the faster way overall because you learn and trade at the same time. And even if you’re a beginner, the risks in your trades are already managed because of the use of these signals – this will prevent your inexperience from blowing your capital away.

Be prepared for a trial and error phase though – not all providers are profitable. Try and try different ones, whether free or paid, to see which one suits your needs, which one is comfortable for you.