The best way to source funds urgently is through personal loans. Irrespective of whether you want to consolidate your debt, seek a home renovation, attend to health emergency needs or others, a personal loan is a quick way of acquiring the necessary funds.

The interest rates for a personal loan are lower than that of credit cards or other consumer debt solutions. And Personal Loan Pro is one of those popular platforms allowing you to acquire personal loans quickly and at a reasonable interest rate.

This is a brief review of the features, working and other attributes of Personal Loan Pro. Follow along until the end to know why it is the best platform to seek your personal loan.

Understanding Personal Loan Pro

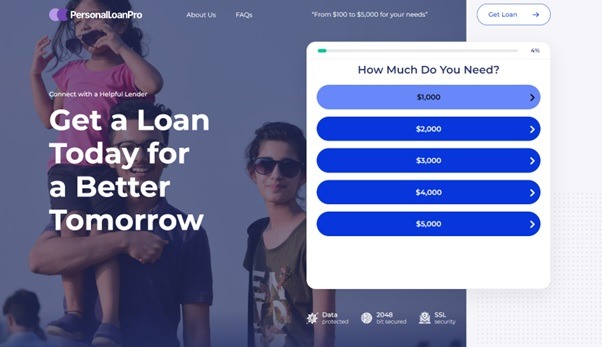

Whether you want $1000 or $5,000, Personal Loan Pro is your one-stop hub to give you numerous lenders within their network for you to choose from. It takes just ten minutes to determine whether you are eligible for a loan without hampering your credit score.

While you have a long list of lenders with Personal Loan Pro, you can shortlist the ones of your preference by comparing their terms, conditions and policies. So, you can conclude that Personal Loan Pro is probably the best personal loan firm that allows you to compare various financing options.

The company makes its business from the lenders and not from the borrowers. The only thing to remember is that Personal Loan Pro doesn’t lend money but acts as a medium to connect lenders and borrowers. The money is dispersed from the lender’s account upon their set of approvals.

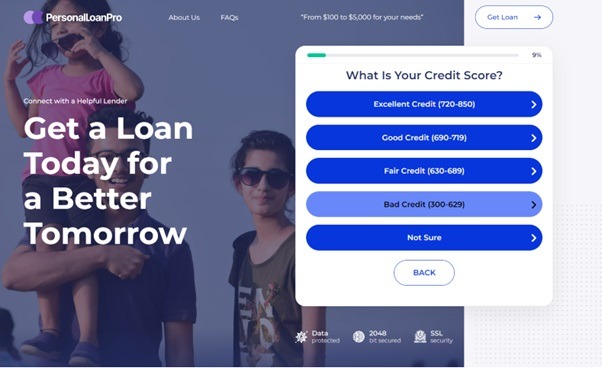

On average, you get to opt for a rate of interest between 2.49% to 35.99% and a repayment period of up to 180 months. But your window of options depends on your credit history and the lenders’ policies. Moreover, different lenders have varying requirements for the credit scores of borrowers.

The Pros & Cons of Personal Loan Pro

To give you a brief insight into what you can expect from Personal Loan Pro, here is a list of pros and cons for you to relate:

Pros:

- Flexible loan options based on amount, terms and rate of interest.

- Rates of interest are lower than credit cards or other personal financing options

- The application is simple to use and navigate, with clear accessibility of features

Cons:

- No guarantee for any approval, as it is done from the lenders’ end

Why Personal Loan Pro?

It is true that when you search for easy personal loan options over Google, you will be open to choosing from a big array of options. But, trusting the legitimacy of these platforms has been in question for a long time.

As we have practically tested Personal Loan Pro, it proves its authenticity by allowing you to connect with the lenders directly without being the mediator of the deal. This application is just a platform that lists a network of lenders for borrowers to find them all at once place.

You don’t have to go by just one offer that most of the other personal loan lenders online are offering you. Here, you can go with the lender; its offer and interest rate only if that seems feasible.

This web app also takes your privacy a bit seriously. There is an integrated security and encryption method to keep your data private. Such data won’t be used without the consent of the owner.

So, Personal Loan Pro doesn’t decide on your behalf and won’t be responsible for any form of approval or denial from the lenders’ end. With that amount of feasibility, Personal Loan Pro has proven its authenticity in providing a personal loan. If you intend to learn more about Peosonal Loan Pro, then visit its website right away.

How Does Personal Loan Pro Work?

If you are a new borrower and haven’t interacted with any process earlier for acquiring a personal loan, then you might have to understand how Personal Loan Pro works through a stepwise breakdown:

Step 1: Be Eligible

To start your loan application process with Personal Loan Pro, you must fall under the eligibility criteria. The eligibility criteria are as follows:

- The borrower must be at least 18 years of age.

- One should be a US citizen or a lawful Permanent Resident

- One should have a steady income flow with current job role for at least three months

- The monthly payout for a borrower should be at least $1000, with post-tax deductions

Step 2: Fill out a Form

When you are done registering yourself on the website and are about to seek a loan, you will be asked to fill out a form on the website. This is the general inquiry that will be shared with the network of lenders when you decide to choose one.

The lenders will review the application and then decide on what amount of loan would be fit for you, the terms, maximum repayment tenure and the rate of interest.

Step 3: Review the Lender’s Information

You might apply to various lenders and review the offers from all of them. For better details on individual offers, you can redirect yourself to their website and check all the associated details on the loan, applicable rates and other such information.

Step 4: Finalizing the Lender and Signing the Agreement

After thoroughly reviewing the offers given by lenders and the associated factors, you can go ahead and finalize your pick. When done, you will be asked to wait for the final approval from the lender and then sign the agreement for the same.

Step 5: Get the Funds in Your Account

Once the agreement is signed and all of the verifications are done, the lender will deposit the money in your bank account. That is it! You can now utilize the funds the way you intend to.

Final Verdict

So, here is a clear understanding of how Personal Loan Pro is a stand-out funding mediator for borrowers and lenders. The lenders are liable to pay a fee to Personal Loan Pro for listing them on its platform. The lenders are instructed to disburse the money instantly after the final approval.

Even though Personal Loan Pro doesn’t interfere with the decision-making between borrower and lender, it still offers a support service to handle your grievances or queries related to the lenders or the platform’s features. If you want a better idea of Personal Loan Pro, you must consider using it to know it better.