The 1980s, sometimes called the “Golden Age of Hollywood,” were a period in film history that gave rise to some of the most enduring and well-loved pictures. The legendary movie stars who not only helped to define the time but also had a lasting impression on the entertainment industry were at the center of this revolution in film. The 1980s exposed us to a galaxy of talent that still enthralls viewers today, from action heroes and romantic leads to groundbreaking heroines. In this article, we will take a trip back to the 1980s and pay homage to the captivating and illustrious performers and actresses who graced the big screen throughout that decade, influencing the cultural climate of the era and leaving a lasting impression on the cinema industry. Join us as we reflect on the iconic personalities and performances that shaped an iconic decade.

Denzel Washington

For his role in The Tragedy of Macbeth, Denzel Washington may receive his ninth Oscar nomination in the year 2022, solidifying his status as one of the finest performers in the annals of Hollywood. The renowned performer became well-known in the 1980s because of his part in the highly regarded medical drama St. Elsewhere.

Washington then leaped to the big screen with appearances in films like For Queen and Country and A Soldier’s Story. Washington was nominated for an Oscar for Best Supporting Actor for his work in Richard Attenborough’s Cry Freedom. Two years later, for his performance in Glory (1989), he would win the prize.

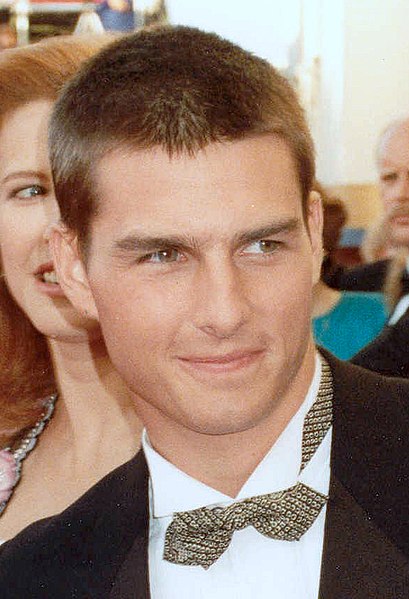

Tom Cruise

Since the start of his career in the early 1980s, Cruise has undoubtedly established a name for himself. Since his breakout performance in the coming-of-age comedy Risky Business (1983), the adored movie actor has undoubtedly enjoyed enormous success. He recently returned to the character in the critically acclaimed box office smash Top Gun: Maverick.

The A-list actor, who is frequently hailed for performing his stunts in the action-packed Mission: Impossible flicks, is now set to feature in two next installments of the franchise, which are scheduled to release in 2023 and 2024, respectively.

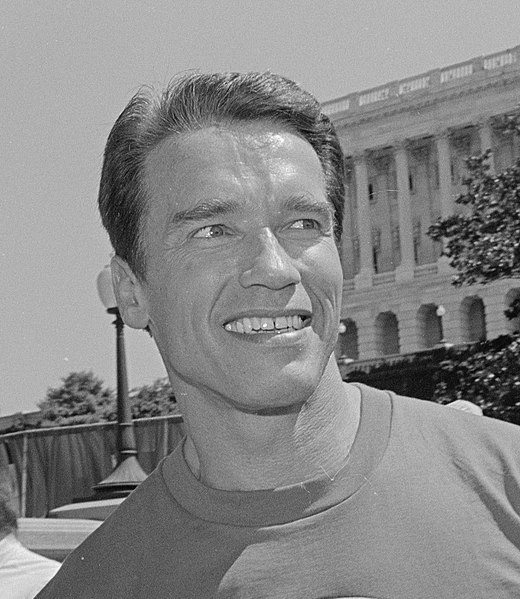

Arnold Schwarzenegger

While he may not be generating much buzz these days, in the 1980s action movie industry, Arnold Schwarzenegger was considered one of the top actors. This actor, who was born in Austria and speaks a language other than English, overcame this barrier to become one of the most successful actors of all time, “with over 50 credits grossing more than $4 billion worldwide.” The former bodybuilder-turned-actor made his name with his performance in the 1982 movie Conan the Barbarian. Later on, he gained notoriety for playing the Terminator in The Terminator, a huge smash throughout the 1980s and even into the 1990s.

Tom Hanks

Tom Hanks is one of the most adored and esteemed performers. The actor is essentially America’s male darling; he is an incredibly captivating and reliable performer who never lets his audience down. Even though Hanks’ genuine fame would emerge in the 1990s, the actor became well-known in the 1980s as a result of two movies that are now regarded as masterpieces.

Hanks made his name as Darryl Hannah’s co-star in Ron Howard’s 1984 blockbuster Splash, which was a huge box-office success. He portrayed Josh Baskin, one of his most recognizable parts, in Penny Marshall’s fantasy comedy Big Four years later. Both movies helped Hanks develop his star persona, which helped him become one of Hollywood’s biggest performers in the 1990s.

Molly Ringwald

For her memorable performances in Sixteen Candles (1984), The Breakfast Club (1985), and Pretty in Pink (1986), the 1980s darling Molly Ringwald is perhaps best remembered. But the accomplished rom-com actress has also appeared in several well-known films of the present, including three Kissing Booth series Netflix originals.

In addition, Ringwald plays Mary Andrews in Riverdale on The CW. The American actress recently appeared in the unsettling biographical series DAHMER, which is presently available for Netflix streaming, as Jeffrey Dahmer’s stepmother Shari Dahmer.

Robin Williams

Everyone cherished the late Robin Williams as an actor. He was able to draw in a sizable following because of his humorous brilliance and his kind nature. For Williams, the 1980s were a significant decade because it was the time of his big-screen debut in Popeye (1980). In the comedy Mork and Mindy, he also portrayed Mork. But it was The World According to Garp, in which he portrays Garp, that revealed to the world that William is not just a funny man but also a good actor. Williams received a lot of accolades in 1989 for his depiction of John Keating in Dead Poets Society, which is now considered a masterpiece.

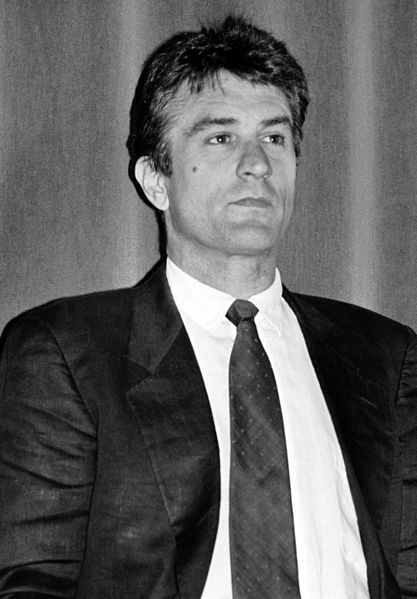

Robert De Niro

As the 1980s got underway, Robert De Niro won his second Oscar for his now-iconic performance in the Martin Scorsese-helmed film Raging Bull. De Niro had previously appeared in some of his most well-known movies, such as Taxi Driver and The Deer Hunter, and had won an Oscar for his supporting performance in 1974’s The Godfather Part II.

In the 1980s, De Niro’s career continued to flourish, solidifying his reputation as one of the most highly regarded performers of the decade with roles in movies such as Once Upon a Time in America and The King of Comedy. With blockbusters like The Untouchables and Midnight Run, the actor has established a reputation as a top box-office attraction.

Winona Ryder

Winona Ryder made her cinematic debut in the 1986 movie Lucas (1986), but she has remained a familiar figure in the film and television industries because of her talent. While Ryder might never again be cast in roles as legendary as those she played in Beetlejuice (1988) and Heathers (1988), we think Joyce from Stranger Things (also set in the 1980s) comes very close.

The actress has a great future ahead of her thanks to the release of the thriller Gone in the Night (2022) and the next seasons of Stranger Things and Disney’s live-action Haunted Mansion.

Anthony Hopkins

Anthony Hopkins, the oldest actor to win an Oscar, has been slaying Hollywood for decades and never ceases to astound audiences with his incredible performances. Hopkins struggled to achieve success in Hollywood before playing Hannibal Lecter in The Silence of the Lambs in 1991. Nevertheless, he was able to gain recognition thanks to his roles in The Elephant Man (1980), The Bunker (1981), The Hunchback of Notre Dame (1982), and The Bounty (1984). In reality, he won an Emmy for his depiction of Adolf Hitler in The Bunker. Hopkins gained notoriety afterward for his ability to play tough characters.

Kurt Russell

Kurt Russell rose to fame as an A-list celebrity in the 1980s despite having started as a Disney child actor in the 1960s and 1970s. With 1981’s Escape from New York, Russell cemented his reputation as an action hero and started a long-term partnership with writer-director John Carpenter. Russell would go on to feature in The Thing, probably Carpenter’s finest 1980s film, and 1986’s Big Trouble in Little China, another action adventure.

In addition, Russell provided the voice for the Disney animated classic The Fox and the Hound. He also won plaudits for his supporting role in the 1983 film Silkwood. Alongside Sylvester Stallone, he would close the decade with another box office hit, the buddy police comedy Tango & Cash.

Jennifer Grey

Jennifer Grey featured in a couple of hit films before her time on Dirty Dancing (1987). The actress had a breakout performance in the renowned adolescent comedy Ferris Bueller’s Day Off (1986), and she had a successful playing debut in the film Reckless (1984).

Grey has played a variety of parts in films and TV shows up to this point, including well-known shows like Grey’s Anatomy and Dollface. The actor from the 1980s will play the lead role in the yet-untitled Dirty Dancing sequel.

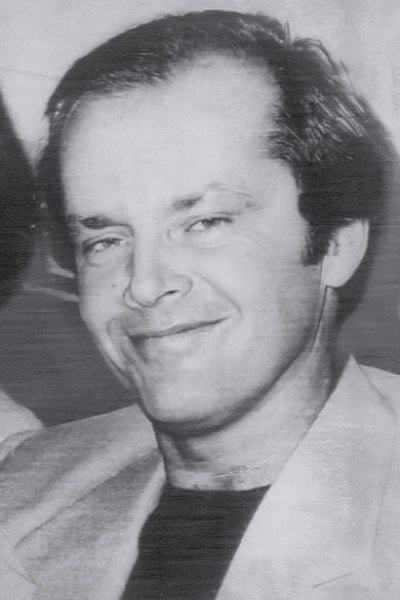

Jack Nicholson

Jack Nicholson will always rank as one of the greatest horror performers of all time for fans of The Shining. The 1980 film The Shining, directed by Stanley Kubrick, still makes headlines today, in large part because of Nicholson’s depiction of Jack Torrance. While Nicholson may have had many more incredible opportunities as a result of this iconic performance, Easy Rider gave him his big break in 1969. But Nicholson dominated Hollywood in the 1980s with blockbuster movies like Prizzi’s Honor (1985), Reds (1981), The Witches of Eastwick (1987), and Ironweed (1987), several of which earned him nominations for Oscars. With yet another critically lauded performance as the Joker in the 1989 Batman movie, he brought the decade to a close.

Michael Douglas

Michael Douglas, the renowned actor Kirk Douglas’s son, is naturally gifted. He received positive reviews from critics during the 1970s and even received an Oscar for directing One Flew Over the Cuckoo’s Nest. The two-punch of Romancing the Stone and The Jewel of the Nile, which established him as a leading man, helped him achieve prominence in the 1980s, nevertheless.

Douglas featured in two movies that have come to epitomize the 1980s as a whole in 1987: Wall Street, one of the finest movies about money, and Fatal Attraction. Douglas received the Best Actor Oscar for playing Gordon Gekko in the latter. For Danny DeVito’s The War of the Roses, another box office success, the actor finished the decade working with Kathleen Turner once more.

Anthony Michael Hall

Many people would recall Anthony Michael Hall from his memorable The Breakfast Club performance opposite Ringwald (with whom he had also previously been in Sixteen Candles), even though he began acting in commercials at the ripe age of seven. He later starred in Edward Scissorhands (1990) as Kim’s (Ryder) lover.

Since then, Hall has been cast in both well-known and obscure motion pictures. The actor recently worked on the films Halloween Kills and the TV show The Goldbergs, both of which included other ’80s celebrities. He previously played the role of Engel in Christopher Nolan’s The Dark Knight and Mister Kitson in Marvel’s Agents of S.H.I.E.L.D.

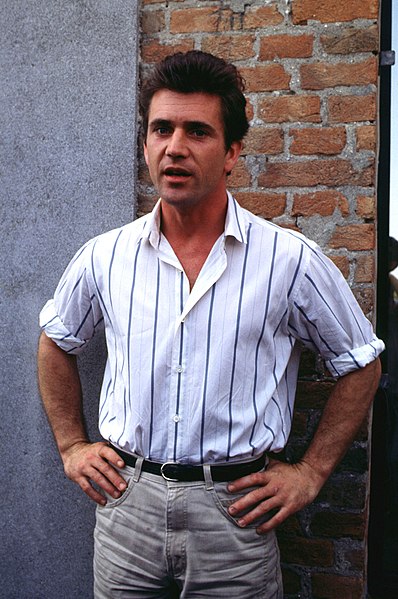

Mel Gibson

Mel Gibson became a worldwide celebrity because of the 1981 film Mad Max 2, the follow-up to the Australian post-apocalyptic series Mad Max. Thus, Gibson’s most prosperous decade was the 1980s. In addition to assuming the lead role in The Bounty (1984), he was able to dominate the romantic drama genre with his portrayal of Guy Hamilton in The Year of Living Dangerously (1982), continue to thrive in the action genre with Mad Max: Beyond Thunderdome (1985), and also win an AACTA Award for Best Lead Actor through his performance as Frank Dunne in the war drama Gallipoli (1981). The actor is now dominating news coverage for the film he is directing, The Passion of the Christ: Resurrection.

Harrison Ford

Harrison Ford was the only male performer to truly own the 1980s. Ford began the decade playing the part of Han Solo in The Empire Strikes Back, followed by 1983’s Return of the Jedi, following his breakout performance in 1977’s Star Wars. Playing the now-iconic Indiana Jones character, Ford also had another successful franchise at the time, beginning with Raiders of the Lost Ark in 1981. During the 1980s, the actor would reprise his role as Indy twice.

Ford has starred in several famous films, such as Mike Nichols’ Working Girl, Peter Wier’s The Mosquito Coast, and Ridley Scott’s Blade Runner. Few people are aware that Ford was nominated for an Oscar in the 1980s for his performance in Witness. The actor was without a doubt the king of the 1980s, and he would carry on with his prosperous career far into the 1990s and the new century.

Michael J. Fox

Anyone who appreciates a good science fiction film is probably familiar with Michael J. Fox. The American actor, still used by his stage name Marty McFly, debuted five years before going global with his performance in Back to the Future (1980).

Even though Fox has been in a lot of movies since then, the one directed by Robert Zemeckis is still the most remembered; the actor returned to the character in two more movies. Funny enough, one of his most recent films is the Netflix original film See You Yesterday, which similarly deals with time travel.

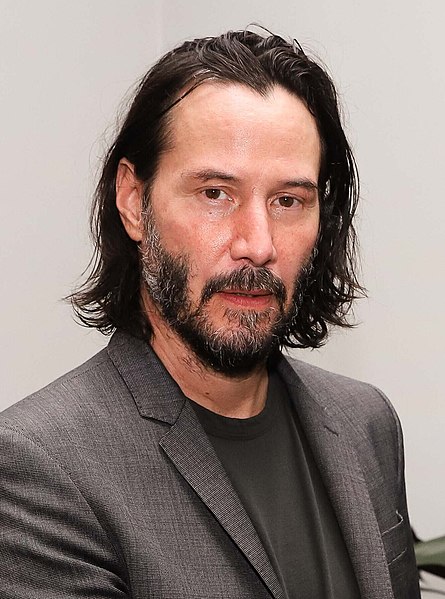

Keanu Reeves

Keanu Reeves made his fame in the film business in 1989 with a breakthrough performance in the science fiction comedy Bill & Ted’s Excellent Adventure, and he is still well-known today. In addition to having exceptional skill, the actor has played some legendary roles ever since.

Reeves has surely drawn in a lot of people over the years, whether it was for his portrayals of Neo from The Matrix or John Wick from the same-named film series. John Wick 4 will be released in 2024, and a fifth movie is now in pre-production. Additionally, the actor will return to the part in Constantine 2.

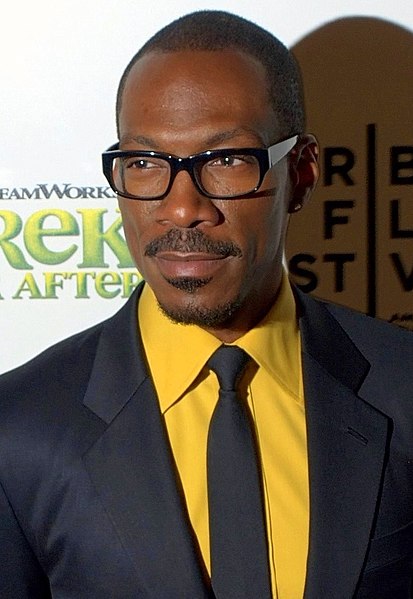

Eddie Murphy

Eddie Murphy, an actor, singer, and comedian, rose to fame on Saturday Night Live, a sketch comedy program for which he was a regular performer from 1980 to 1984, and is best remembered for his hilarious portrayal in Beverly Hills Cop (1984). In addition to a plethora of other notable films, Murphy’s cinematography includes Dr. DoLittle (1998) and Norbit (2007).

Thirty-three years after the original Coming to America (1988) film, Coming 2 America debuted in 2021. Additionally, a new Beverly Hills Cop sequel is in the works.

Ralph Macchio

Ralph Macchio began his career in a variety of TV advertisements, just like Hall. Before gaining worldwide recognition for his iconic performance in The Karate Kid in 1984, Macchio made his feature film debut in the 1980 comedy Up the Academy.

Even though The Karate Kid is still the actor’s most famous character, he has starred in other films. In A Good Night to Die, for example, he portrays a hitman, which is a little different from the roles he had played before. Presently playing Daniel LaRusso once more, Macchio may be seen in Cobra Kai.

Judd Nelson

The actor became well-known for his portrayal of the haughty, tough man in The Breakfast Club the following year, despite making his film debut in Making the Grade in 1984. In addition, Judd Nelson starred in Blue City (1986) and St. Elmo’s Fire (1985). None of these, however, received the same level of praise as the ones that came before.

His most recent appearance was in The Most Dangerous Game (2022), however, Nelson has been appearing in lesser movies like Girl in the Basement (2021).

Conclusion

The movie stars of the 1980s created a lasting impression on the film industry by developing characters and giving performances that still hold viewers’ attention. Their enduring impact serves as a reminder that there are no limits to the brilliance of the silver screen. These legendary actors will always be seen as the center of attention at a period in Hollywood history that will never be forgotten.