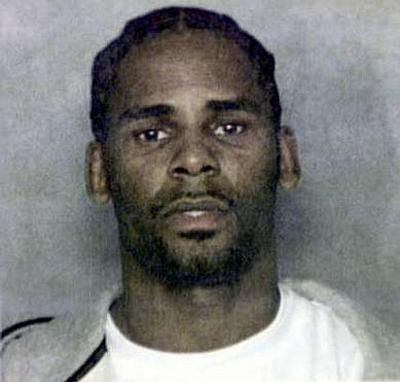

R. Kelly, a name that resonates with many for reasons both artistic and controversial, has undoubtedly left a significant mark on the world of R&B and popular music. His journey from the streets of Chicago to the top of music charts is a tale of talent, turmoil, and controversy. R. Kelly’s public persona as a charismatic, soulful artist often clashed with his private life, marred by legal troubles and controversies. Despite these challenges, his impact on music remains undeniable.

From Humble Beginnings to Spotlight

Born in Chicago, R. Kelly faced numerous obstacles in his early life, including poverty and personal loss. These hardships, however, shaped his musical journey, infusing his work with depth and emotion. Kelly’s foray into music began in high school, where he discovered his passion for singing and songwriting, setting the stage for a career that would soon take off. Influenced by soul, gospel, and R&B legends, R. Kelly honed a unique style that would later define his music. These early influences are evident in his melodious voice and storytelling lyrics.

Defining Moments in a Storied Career

R. Kelly’s career in the music industry is marked by a series of defining moments that highlight his influence and talent. These moments are best exemplified by his top hits and the numerous awards he has received.

Breakthrough Albums and Singles

R. Kelly’s breakthrough in the music industry was marked by several albums and singles that not only topped the charts but also shaped the sound of R&B in the 1990s and early 2000s. Some of his most notable works include:

- Albums:

- “12 Play” (1993): Known for its sensual and seductive tone, this album established Kelly as a leading figure in R&B.

- “R.” (1998): A double-disc album featuring a mix of hip-hop and R&B, it showcased Kelly’s versatility.

- “Chocolate Factory” (2003): This album, released amidst various personal controversies, received critical acclaim and commercial success.

- Singles:

- “I Believe I Can Fly” (1996): Perhaps his most iconic song, it transcended R&B and became an inspirational anthem.

- “Ignition (Remix)” (2002): A catchy and popular song that became a staple in parties and clubs.

- “Bump N’ Grind” (1993): A song that dominated the R&B charts and became synonymous with Kelly’s early style.

Award-Winning Moments

R. Kelly’s musical talents have been recognized with numerous awards and accolades throughout his career. Some of the most notable include:

- Grammy Awards – Kelly won three Grammy Awards for “I Believe I Can Fly,” including Best R&B Song, Best Male R&B Vocal Performance, and Best Song Written for a Motion Picture or Television.

- American Music Awards – He received awards for Favorite Soul/R&B Male Artist and Favorite Soul/R&B Album for “TP-2.COM.”

- BET Awards – Kelly was honored with awards including Best Male R&B Artist and Viewer’s Choice.

- Billboard Awards – He achieved recognition for his chart-topping singles and albums, reflecting his commercial success.

These awards and his list of hit songs are a testament to R. Kelly’s significant impact on the music industry and his ability to resonate with a wide audience. They represent the peaks of a career that has been equally defined by musical innovation and personal controversy. Over the years, R. Kelly’s music evolved, showcasing his versatility and willingness to experiment with different genres and themes.

The Soundtrack of a Generation

Songs like “Ignition” and “Step in the Name of Love” became anthems for a generation, showcasing his ability to create timeless hits. Albums such as “R.” and “Chocolate Factory” defined an era in R&B, setting new standards for the genre. Kelly’s music often revolved around themes of love, struggle, and triumph, resonating deeply with his audience.

Conclusion

R. Kelly’s journey in the music industry is a complex one, marked by extraordinary talent and significant controversy. While his musical legacy continues to influence artists and fans, his personal life remains a topic of intense debate and scrutiny. His story is a reminder of the often blurred lines between artistic genius and personal conduct in the world of celebrity.