A Doji is the opposite of a hammering pattern. When prices close at the lowest point, it represents indecision in trading.

A Doji pattern can be interpreted as uncertainty in price movement. This pattern consists of two sessions where the open, high, and low are virtually identical. Observers take this action to mean that nothing new has changed or come about during this period. Next week, a breakout might occur Tuesday or Wednesday if Monday’s observation was an actual Doji pattern.

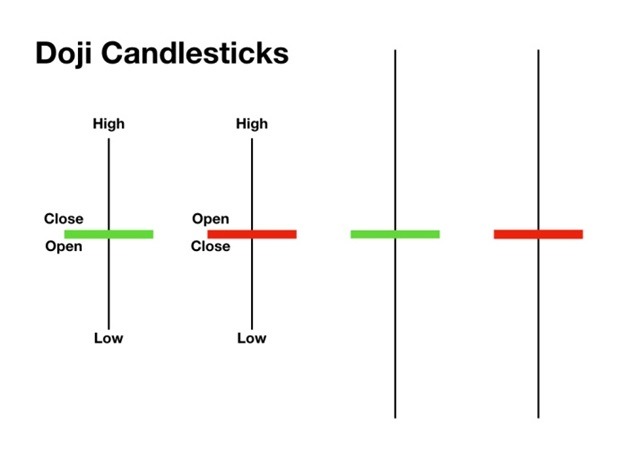

Doji Candlestick Patterns As with all of the candlestick patterns, Doji candles require confirmation by a close before they can be relied upon. Just because the candle looks like a Doji doesn’t mean that it is one. The open, high and low must be equal or very nearly equal in value with little or no shadows at the end of the day. The confirmation comes from a second day where the close is within a few points of being identical to yesterday’s close.

The Doji Pattern

If today’s closing price equals yesterday’s open, high, and low, a Doji is formed. The candlestick itself acts as a sign of indecision; it has no upper shadow and no lower shadow. It can be found at either an uptrend or a downtrend where few or no trendlines confirm the current direction of price movement.

When traders see this pattern, they often believe that a breakout will occur on the second day.

Doji Confirmation

A Doji can be confirmed by a gap up or gap down. If the close is below yesterday’s open, high and low, and the distance between the two closes is the same as that of the Doji Candlestick Pattern, there will be a gap down on day two. On days of no confirmation, traders believe that little or no change occurred during the period and is just a continuation of yesterday’s trend. A Doji has no upper or lower shadows. The stock may open at $10 close at $10, resulting in a confirmation of price movement, with no change in either direction.

The significant feature of a Doji is that it is coupled with the previous session’s extreme and is represented by a long candle, thus the name; however, it can also be a short candle if the previous session’s extreme was short. Hence, the price does not go beyond the previous day’s high and low.

Characteristics of a Doji

The Doji has two sessions where the price action is the same. There is no gap, either up or down, between the two sessions in which the open, high and low are nearly equal. It is not a true Doji if there are gaps in both sessions; it is simply a pattern that does not look like the Doji.

A Doji can be found within the middle of any range between the opening and closing price. It is usually found at its peak or close to previous periods and may result from a strong trend or a weak trend. It can be an impulse or continuation pattern.

Impulse pattern

If the Doji occurs at the end of an uptrend, it indicates that the buyers and sellers are equally strong. The market is likely to continue moving in the same direction as before.

Continuation pattern

If a Doji occurs at the end of a downtrend, it may signify that price will continue lower on the next day. However, it is not always reliable because downtrends can result from the exhaustion of sellers or the accumulation of buyers before a reversal.

If the open, high and low are nearly equal to yesterday’s, then the Doji is not valid.

The candle consists of two sessions where the high and the low are very close in value. This is often drawn when the price has moved in a strong trend because it signals indecision in trading. The candlestick itself acts as a sign of indecision; it has no upper shadow and no lower shadow.

The other session does have a small gap, and the time frame of the second session is longer than that of the first.

Doji patterns are easiest to see in the middle of a trend, either upward or downward. The range between the opening and closing price is often used to define the middle of a trend.

Given the same price action in both sessions, a Doji is an indication that there is indecision in the market. Traders may interpret this as uncertainty in whether or not the price will soon break out from its current level. This can be seen as a bullish or bearish signal depending on whether it occurs at an uptrend or a downtrend.

A Doji In an Uptrend

The Doji indicates indecision about the direction of the trend. It is a sign that prices are moving in the same direction.

This can be seen as a bullish signal if it occurs in an uptrend.

A Doji In a Downtrend

The Doji indicates that the trend will change because of indecision in the market. It represents uncertainty when prices are moving downward. This can be seen as a bearish signal if it occurs in a downtrend.

A Doji is an indication that there is indecision in the market. Traders may interpret this as uncertainty in whether prices are about to break out of the current range and move sharply higher.

This can be seen as either a bullish or bearish signal depending on whether it occurs at an uptrend or a downtrend.

Doji candlstick patterns are useful for short-term trading, but long-term traders should view them with skepticism because of their flimsy nature. They provide little evidence that one continuation pattern will continue longer than another.