There are a lot of people who invest in cryptocurrency as this area of activity gains huge popularity and gives traders a multitude of opportunities to get a passive income. Even beginners are capable of getting up to speed with the trading process due to taking advantage of algorithmic trading.

A huge number of crypto trading platforms provide traders with automated trading methods. One of such platforms is Cryptorobotics. This crypto trading terminal offers many cryptocurrency trading tools to facilitate traders to enter the trades successfully. Among many features of algorithmic trading are considered Copytrading. Let’s figure out what this means, how it works, and is customized on the Cryptorobotics trading platform.

Copytrading definition

Copytrading is also called social trading or mirror trading. The essence of Copytrading is copying the trades of professional traders, which can potentially bring good profits. That is, you choose a professional trader to follow, then copy his trades.

When selecting a trader, whose investment style you are going to follow, you should make sure that his aims align with yours. For instance, if you prefer to invest in a conservative way, then you should copy a trader with a conservative trading bent. Similarly, if you’re a growth investor then you shouldn’t copy the trades of a value investor.

You can copy trades on your own or via a crypto trading platform. The last one enables you to choose various trading activities to copy. As we have already mentioned above, the trader invests your funds instead of you. Trades occur automatically, so you don’t have to do anything. All you need to do is to choose which expert trader to follow and trust your funds. Also, ensure that you have enough funds in your trading account to cover trade activity.

Advantages of Copytrading

- Copytrading provides an opportunity to use an experienced trader’s investment knowledge and skills.

- You don’t need to analyze the crypto market movements or trends to make a decision on which digital asset to purchase, sell or hold. You can simply copy the trades of an experienced trader.

- Copy trading is basically a passive income. You don’t need to work hard on selecting investments. This job is done by professionals. You can get returns in your portfolio without necessarily wasting hours investigating the crypto market. The expert trader makes investment decisions by himself. Risk management is also done as the trading platforms allow using different tools to mitigate the risks.

Cons of Copytrading

There are arguments for copy trading. Nevertheless, this function may not be suitable for every investor. There are a few crucial things to remember before you get started with this strategy.

- Your success depends on an investor’s decisions. There doesn’t exist a perfect trader. Since even experienced traders can make mistakes, you should consider it. Consequently, Copytrading carries a certain risk as there are no guarantees that an experienced trader’s strategy brings you maximum returns.

- You should spend some time studying traders’ portfolios to get more information about how traders execute trades and how profitable they are. The selection of a random trader could lead to losses.

- Pay attention to fees as the Copytrading function could be expensive. If you are interested in paying low fees, you should carefully learn the prices before trading.

Why is Copytrading demanded among beginners?

- Copytrading can help inexperienced traders to study the crypto market and learn trading on their own.

- It is a straightforward and lucrative method to start the trading process that is not required to appropriate knowledge and skills.

- Due to this feature, traders have an opportunity to minimize the losses of their funds.

- This type of Algotrading doesn’t consume a lot of time.

How to customize a Copytrading function on the Cryptorobotics platform?

If you wish to set up the Copytrading tool and start following the experienced trader’s deals, you should:

- Go to the Cryptorobotics trading platform.

- Pass the registration process.

- Select “Algotrading”.

- Click on the Copytrading button.

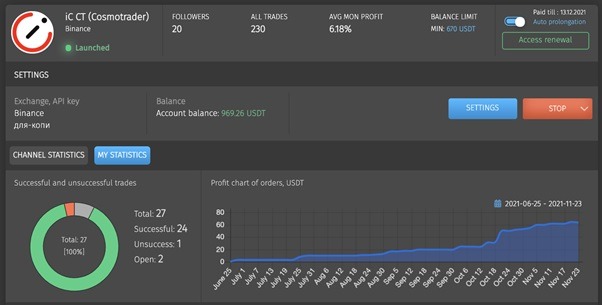

- Buy a subscription to one or several of the traders’ channels.

- Launch Copytrading.

- Select an exchange. Copytrading is currently available on Binance and Binance Futures.

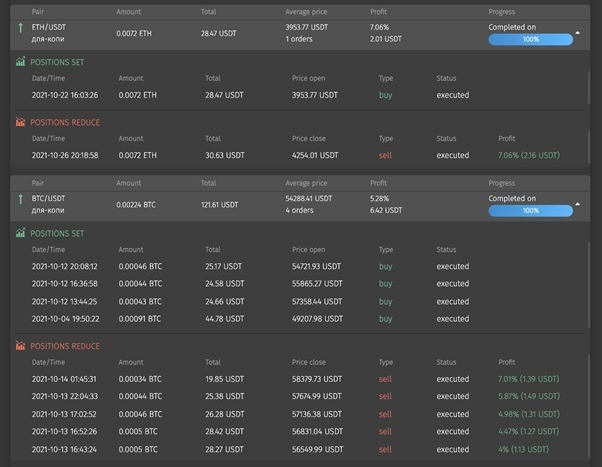

It is worth noting that you have to trade the same digital coin that the expert trader trades (USDT, BTC, etc.).

The same goes for your balance; it must be equal to the trader’s one or be greater than the low balance indicated in the trader’s channel.

Also of note is that for copying trades in each channel, you have to connect a separate account that does not have any other transactions or is not associated with other algorithmic trading instruments.

Conclusion

Copytrading is one of the algorithmic trading methods created to make the trading process automate and improve the investment strategy. This tool helps simplify the entire trading process. Although, every trader should consider that it can work better for some investors than others. Knowing the risks and potential rewards can facilitate you in deciding whether Copytrading is a strategy you should use.