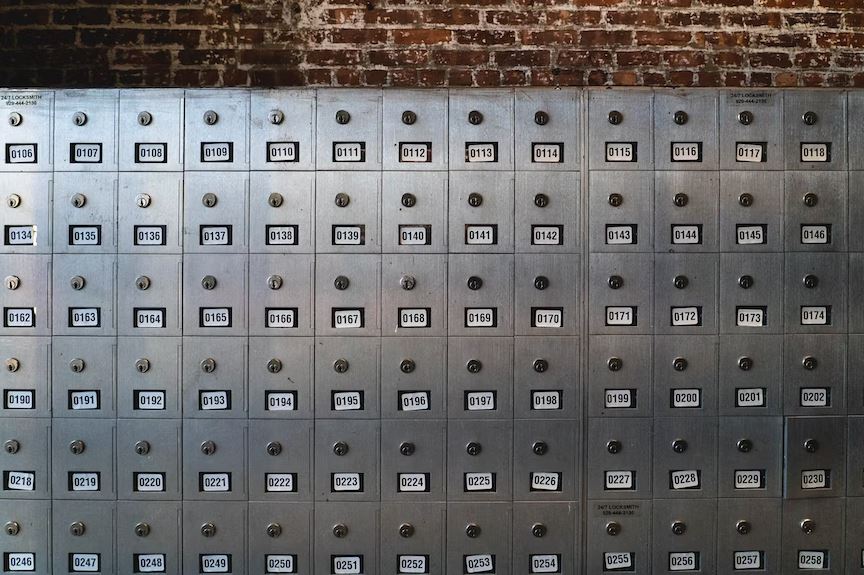

A safe deposit box, also known as a safety deposit box, is an individually secured container typically kept within an area of a bank or vault. It is designed to provide protection for valuable possessions against theft, fire, water damage, tampering, and other possible risks. These boxes are commonly found in banks, post offices, or similar institutions. Moreover, these boxes are used to store a wide range of valuable items, including gemstones, precious metals, cash, investment securities, luxury goods, important documents, and even digital data.

When you rent a safe deposit box, the bank provides you with a key or uses a keyless system for access. In the case of a key-based system, you will receive a key, while a second “guard key” is held by a bank employee. On the other hand, if your bank uses a keyless system, you must scan your finger or hand for authentication. Each time you visit the bank to access the box, you will be required to present some form of identification and your key – if applicable.

Renting a safe deposit box allows you to do so individually or with the option of adding other individuals to the lease. When co-lessors are listed on a safe deposit box, they have equal rights and access to the contents of the box. However, it is important to consider the suitability of potential co-lessors. Individuals with financial, marriage, or judgment issues may not be ideal candidates for co-ownership of a safe deposit box. In some cases, access to the safe deposit box can be configured so that all lessors must be present to open the box. Hence, it is recommended to designate someone with power of attorney who can access the safe deposit box when the co-lessors are unavailable.

Ultimately, safe deposit boxes are ideal for storing hard-to-replace documents such as contracts, business papers, military discharge papers, physical stock and bond certificates, small collectibles and family heirlooms. However, it’s important to note that the largest safe deposit boxes typically measure only 10 inches by 10 inches and are two feet deep, so larger items may not fit inside.

Benefits of Having A Safe Deposit Box

People choose to utilize safe deposit boxes for storing their valuable possessions for various reasons. One of the primary factors is enhanced security. Safe deposit boxes offer a higher level of protection than keeping valuables at home; these boxes are typically stored in areas equipped with advanced security measures such as alarms, cameras, and access controls. This highly prevents incidents of theft and other risks.

In addition to security, the off-site storage aspect of safe deposit boxes is another appealing factor. By using a safe deposit box, individuals can store their valuable possessions in a separate location away from their home or business premises. This reduces the risk of loss or damage due to events like burglaries, accidents, or natural disasters. It provides an extra layer of protection and ensures that the items are kept secure even if unfortunate circumstances occur in the individual’s primary location.

Furthermore, privacy and confidentiality are also important considerations. Safe deposit boxes offer a level of privacy, as the bank or financial institution typically does not have knowledge of the specific items stored inside the box. Access is usually limited to authorized box holders or signatories. This aspect is especially significant when storing sensitive documents or items that individuals prefer to keep private and confidential, such as legal documents, family heirlooms, or valuable assets.

Safe Deposit Boxes In The United States

Safe deposit boxes are considered a “legacy service” in the United States and other parts of the world. However, with the changing dynamics of the banking industry, many new bank branches chose to refrain from offering safe deposit box services to their customers. This shift is driven by various factors.

In the 20th century, bank branches were seen as prestigious establishments. But in the 21st century, the value of space has increased significantly, leading to higher land costs and rents. As a result, many banks now view safe deposit box services as secondary to their core operations, and the space they occupy could be utilized for other revenue-generating purposes.

Moreover, while safe deposit boxes are often perceived as highly secure, there is limited regulatory oversight regarding their actual security. In the United States, for example, there are no federal laws that specifically govern the security of safe deposit boxes or establish rules for customer compensation if the stored property is stolen or damaged. Hence, the contents of safe deposit boxes are not insured by banks or the FDIC (Federal Deposit Insurance Corporation). Individuals can choose to obtain separate insurance coverage specifically for their safe deposit box to ensure additional protection. Depending on the insurance choice, some can cover risks such as theft and other incidents that may occur.

What Happens To Abandoned Safe Deposit Boxes?

When safe deposit boxes are abandoned, the procedures for handling them can vary, depending on the bank or institution and the jurisdiction.

If the annual fee for your safe deposit box were not paid, it would typically be considered dormant if there was no activity – such as fee payment, for a period of three to five years. State laws determine the specific duration required to declare a box as dormant.

In the event that the property remains unclaimed and is classified as abandoned, the bank may have an obligation to transfer the contents of the safe deposit box to the state treasurer or unclaimed-property office through a process known as “escheat” (this is when a property goes to the state because the owner has passed away without a will or heirs, or when the property remains inactive for a certain period of time). Some states mandate that the bank must make an effort to notify the property owner before transferring the property to the state.

If you would like to determine whether any property from your safe deposit box has been sent to the state treasurer, it is advisable to contact the state treasurer’s office or unclaimed-property office. They will be able to assist you in finding out more information.

Conclusion

Safe deposit boxes are widely regarded by individuals as a reliable and secure method to protect their valuable possessions. However, reviewing the regulations of the bank or other financial institution that provides these services is extremely important. While safe deposit boxes are generally perceived as highly secure, not all banks assume responsibility for potential risks or damages to the stored property. Also, understanding what happens to abandoned safe deposit boxes is crucial. The specific procedures may vary, but generally, banks are required to make efforts to locate the owners by sending notifications and waiting for a certain period of time.