Are you thinking of moving to a new estate or country? This decision is often stressful both mentally and financially especially if you are moving with all your house items. In this case, a budget is important. First, you have to examine where you are headed to.

Get to know the rental expenses, cost of traveling to that destination, and other possible expenses you might incur on the way. After calculating these expenses, it’s time to figure out how to finance them. You can do this by:

1. Using Your Savings

Savings are always important to meet unexpected expenses and bill out other expenditures. If you don’t have adequate savings, it’s high time you start keeping them. In this case, it will be so easy since you have a motivating factor: moving costs.

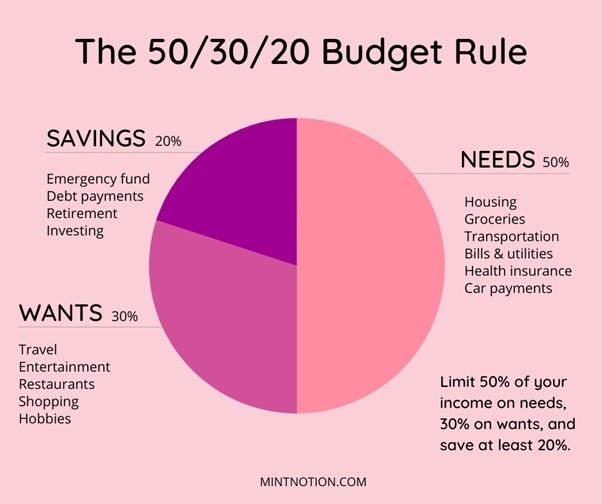

According to Marko, White Board Finance Advisor, “use a 50/30/20 rule.”

“The 50% should cater for needs, that is, what you can’t live without. This includes housing expenses, health, groceries, and other major utilities like electricity,” says Marko.

The 30% should cater for the wants, that is something that you may not need but adds life comfort like clothing expenses, dining out, vacations and so on.

The 20% should be saved. If you have pending debts, use this money to cover them while leaving a small amount for savings. In our case, it may be important to cut down some costs like unnecessary wants to increase the savings for the moving expenses.

Don’t worry, it will only be for a short time until the moving part is over.

2. Ask for Friends, Relatives, and Other Colleagues’ Help

Sometimes savings might not be enough or maybe we urgently need to move out and hence have no time to save. If this is so, why not ask for some help from your surrounding ‘neighbors’?

If you have trustworthy friends, you can ask them for some money. This can also be your employer. Note that I said ‘if you are friends ‘. You don’t want to lose your job on this matter.

To succeed, just tell your story in a nice polite way with an emotional tone. Explain the methods you’ve tried to acquire some money but failed and confidently promise to pay it back at a specific time. If this option succeeds, ensure you fulfill your promise.

The good thing about this option is that no interests are involved. And even if some people might want some extras, the amount will be lower than loans.

3. Take a Loan

Loans are common these days. They are easily accessed by banks, online lenders, and credit unions. The best thing is that it’s possible to get a loan in just 5-10 minutes after application from the online lenders like the quick cash loans st. Louis mo.

Advantages of Taking a Loan

- Quick access especially for online loans. Banks have also tried to simplify and fasten the application process and approval time;

- A variety of loan types and loan lenders makes them easily accessible and easy to find lenders with the best terms;

- The loans can be used for almost anything;

- The presence of customer care services improves the quality of loan services;

- 24-hour service operation makes some loans more convenient.

Disadvantages

- Some loans have high interest;

- If not careful, these loans may hurt your credit score;

- The long bank application process makes them inconvenient.

4.Get a Side Hustle

To increase your savings, you can start a part-time job. Identify your skills and hobbies and figure out how you can monetize them.

For instance, if you have a passion for gardening, why not grow some fruits or veggies and sell them to your neighbors or in a market on weekends. You can also start an online job like freelancing, life coaching, online selling, and many more.

Conclusion

Financing your moving expenses does not have to be that hard. You just need a good strategy to do that.