Creating your own business and being your boss is what most people aspire to. When achieved, it’s an exciting moment, but it brings along many responsibilities. One of them, and one that we least like, is tax filing.

Adding to this, the U.S. tax system is complex and has more than 97 tax categories. Yes, 97! Learning all of them, while not necessary, is not an option. Now, the reality is that if we don’t do it, someone else will have to do it for us.

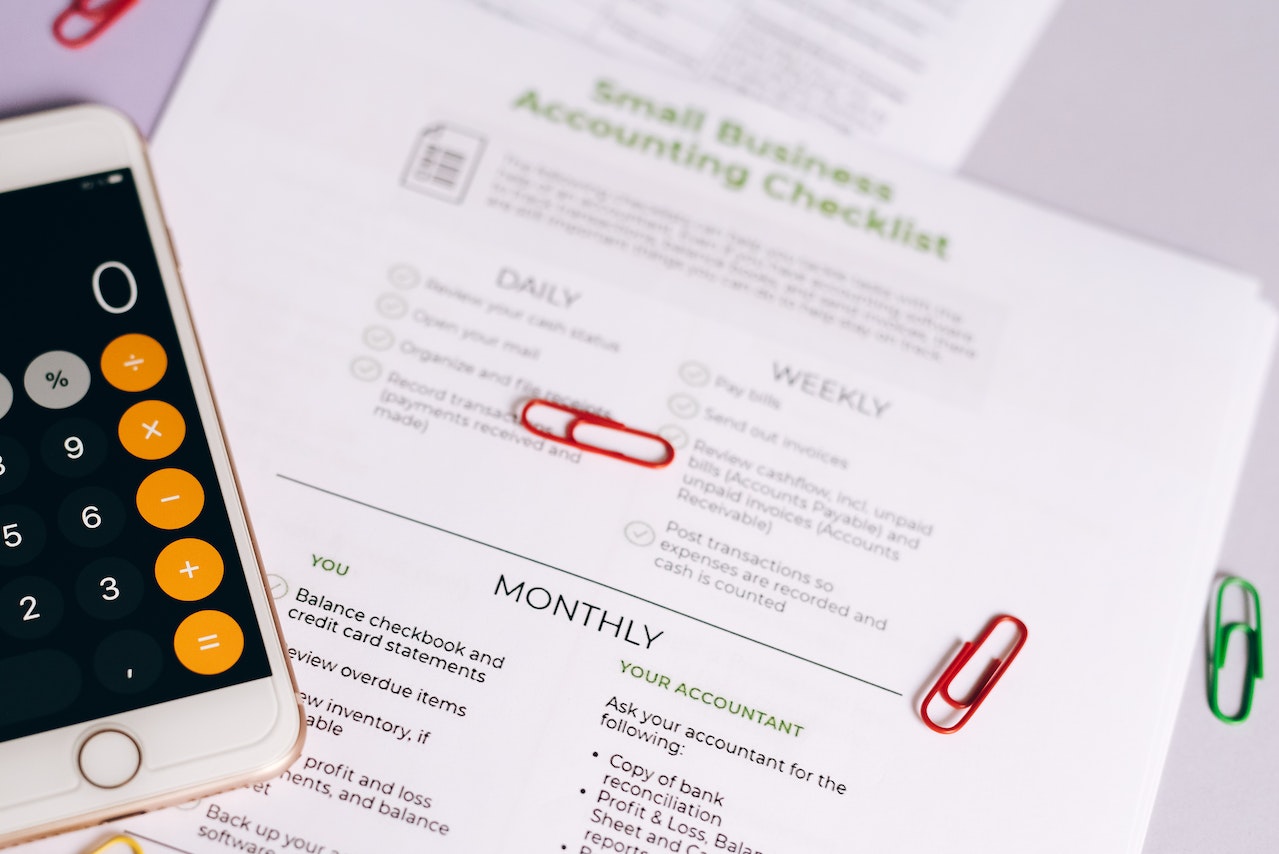

Although having an accountant in companies is not obligatory in the USA, the recommendation is always to have a professional or a team of professionals to take care of the accounting aspect to ensure that there are no errors.

One of the most reliable options is a CPA in Houston called Evans Sternau, a global network of committed CPAs and accountants that focuses on providing customer service strategies and resolving industry challenges.

Now, you can also start the declaration process yourself and then delegate it. The first part is simple and mainly involves collecting documents and filling out some forms.

What do I need to prepare my company’s tax return?

You need copies of all your financial statements for the year. These include:

Profit and loss statement

Balance sheet

Cash flow statement

You will also need to answer some questions about what your company produces, to which industry it belongs, in which state of the country you do business, and provide a list of all owners.

Other important forms you will need include:

If you’re a sole proprietor or single-member LLC: Schedule C for business profits or losses.

If your company is a multi-member LLC or a partnership: Form 1065 for the LLC or partnership. Each partner must submit a Schedule K-1 along with their tax return.

If your company is an S corporation: Form 1120-S.

If it’s a C corporation: Form 1120.

In most cases, your share of business profits is included in your return along with personal income, deductions, and credits. This determines your taxable income.

It might sound too confusing, but don’t worry! Keep in mind that the Government will tell you if you paid more than you should have. If that’s the case, they will refund the excess money. And remember: you always have the option to consult specialized advisors.

There are numerous firms dedicated to providing national tax advisory services like Evans tax service, and if you’re starting on this path of creating your own business, it’s wise to seek advice from one of them.

What expenses can I deduct from my taxes?

But don’t get discouraged, it’s not all about paying. There are some benefits we have when declaring our taxes.

You probably had to buy many things like computers, phones, and other office materials to get your business started. The good news is that all the money spent on these items can be deducted from your taxes. And deductions save you money!

Here’s a list of expenses you can deduct:

Business insurance

Office supplies

Computers and equipment

Home office expenses (services, rent/mortgage, office furniture)

Company phone bill

Professional fees (lawyers and accountants)

Employee wages and benefits

Self-employment tax

Marketing and advertising

Tax preparation fees and bank charges

Vehicle expenses (if used for business purposes)

Business travel expenses

Conference expenses Meals (50% deductible)

You’re all set to file, and now?

First, you’ll have to choose between filing your business tax return on your own or having a professional do it for you. If you decide to do it yourself, you’ll need a tax software program to input your information, answer some questions, and file it. You can also fill out paper forms and mail them to the Internal Revenue Service (IRS).

If you hire a professional to file your tax return for you, you’ll need to provide them with all the correct documentation and forms mentioned earlier. The professional will input the information and file it with the IRS on your behalf. Remember that hiring a professional is tax-deductible!

Now, it might be the case that your company hasn’t made any money yet. That is, your income has been zero or negative. If so, you might not have to pay taxes.

Nevertheless, the IRS might still require you to file a tax return. Even if your business hasn’t generated profits, it’s always better to file your return.

As you can see, filing taxes is not as complex as it seems, but it requires many stages of gathering information and, above all, having a clear understanding of your company’s numbers to avoid making a mistake in the filing and having it result in future problems.

That’s why, beyond the possibility of doing it on your own, professional advice is always recommended to review and give approval before submitting the declaration.

It’s all up to you. But remember that if your decision involves cutting costs, seeking advice falls under the expenses you can deduct.