At the initial stage in retirement planning, it is important to consider various aspects of the investment process.

Identify Your Goals

As you plan for retirement, consider what lifestyle you would like to have once you stop working.

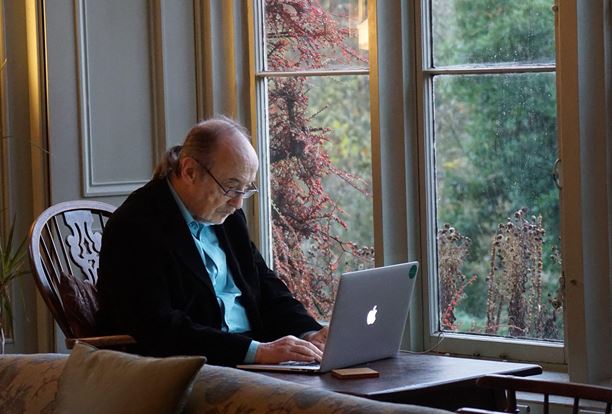

Travel may be on your list; painting and writing or other creative hobbies might interest you too; spending more time with family and friends could also be on the agenda; perhaps pursuing a new career could even be in the cards! You can visit https://www.statista.com/most-popular-hobbies-among-retirees/ for more ideas.

Whatever your prospective hobby may be, understanding what these activities cost will help determine how much savings are necessary.

Additionally, it’s important to consider how much income will be needed during retirement. This may include your earnings from savings and investments as well as sources like Social Security benefits and veterans’ benefits – though these resources may supplement but not replace employment income.

As part of your retirement savings goals, it’s essential to remember inflation will raise prices over time and plan accordingly.

Most experts advise setting aside at least 15% of income each year in retirement savings if possible; otherwise set a goal to gradually increase that percentage each year until you meet it.

Many employers offer retirement savings plans to employees, such as traditional IRAs, Roth IRAs, 403(b), or government 457(b). These accounts enable workers to save tax-deferred funds until retirement when withdrawing funds; self-employed people may also invest in personal retirement accounts such as sole proprietorship SEP IRAs and SIMPLE IRAs.

Additionally, you may choose to add alternative investments to help diversify your portfolio and protect against economic downturns. You can visit Goldco for more information. Be sure to research any investment opportunities thoroughly.

Consider also creating a “rainy day” fund to cover unexpected expenses that are likely to arise during retirement, such as medical bills or roof repair needs. Being prepared can be extremely useful when living off fixed income; liquid investments or cash can make this savings plan easy to access when necessary.

Determine Your Time Horizon

Step one of retirement planning involves determining your time horizon, or the approximate date when you wish to stop working. While this might seem like a straightforward concept, its significance lies in how long is left until your planned retirement date and its effect on savings strategies, investments decisions and overall retirement planning strategies.

Time horizon is defined as the amount of time it will take you to achieve a specific goal, such as saving enough money for a car purchase – or lifestyle goals such as when to retire. This number can differ for each individual and circumstance.

Short, intermediate, and long-term investments typically fall into three distinct time horizons: short-term goals (like saving for a house down payment in less than five years), intermediate investments (10-20 year horizon) such as saving for retirement or sending children off to college and long-term accounts such as 401(k)s and IRAs are usually used for investing.

Your investment strategy should adapt as your time horizon shifts; as retirement nears, more conservative assets should be in your portfolio.

Long-term investors with access to funds should lean heavily toward equity as they can weather periods of lower returns; as you approach retirement age however, you may wish to begin shifting away from stocks in favor of fixed income instruments like bonds, CDs and money market accounts with higher yields.

No matter your financial needs and situation, it is wise to conduct regular reviews of your time horizon. Many factors could alter it including unexpected expenses, an abrupt rise or drop in living costs and changes to life expectancy.

If you need guidance in changing your retirement savings or investment strategy it would be advisable to speak to an experienced financial professional as they will provide solutions tailored specifically towards preparing for retirement. Visit angi.com for impartial reviews of service providers.

Estimate Your Income Needs

Most people look forward to retirement as an opportunity to pursue hobbies and interests without the pressures of work, children and mortgage payments. Unfortunately, determining how much income will be necessary for you to live comfortably during retirement can be an intimidating challenge that takes careful thought and consideration.

Financial experts generally suggest saving enough to replace 75% of your pre-retirement income in retirement. This figure takes into account numerous variables, including when and where you plan to retire as well as lifestyle preferences and healthcare costs that might arise during this time.

Use a specialized online investment calculator to help estimate how much money is necessary for retirement. Please keep in mind that it can only provide an approximate estimate and should not replace professional financial planning advice or investment advice.

Determining your retirement needs means factoring in how long you expect to live after retiring. If you plan to live to 100, you’ll need a nest egg to help you do it!

As part of your retirement income calculations, be sure to take into account any financial sources such as Social Security benefits, pensions, savings and investments, rental properties and part-time employment. You will also need to plan for taxes during retirement as well as expenses like travel or new kitchen purchases and any anticipated expenses.

Debt levels should also be carefully considered. In general, you should aim to pay off all outstanding debts before retirement so that you can withdraw funds from savings and investments without risking your Social Security benefits or other sources of income in retirement. You can visit this site to learn more about how to get out of debt.

Debt management is essential to overall financial health, and some forms of debt may even prove helpful when planning for retirement. A home equity loan or credit card might offer lower interest rates than some other forms, giving you more time to build up a nest egg quicker.

Establish a Savings Goal

Your next step in this process is to establish a savings goal. From there, create a plan to save regularly through direct deposit or an individual retirement account (IRA).

Also keep an emergency fund ready: this could come in handy should anything unexpected come up, like car repairs or medical emergencies requiring treatment; many financial professionals recommend keeping enough savings for three to six months’ expenses in an emergency fund.

Advice has often been given on how much a person needs to save for retirement, with figures such as 10x your final salary or having a nest egg equaling approximately 80%-90% of pre-retirement income being mentioned as recommendations. While these guidelines can be helpful, every individual’s circumstances vary widely and each plan should be tailored individually.

Once your goals and timeline are set in stone, it is time to create separate accounts for each goal to make managing them simpler; this can help you determine how much savings is necessary monthly. It would also be prudent to discuss your goals with your spouse or significant other so everyone is on the same page.

At the core of retirement planning lays an unshakeable fear of failure. While it’s easy to be put off by slow savings progress or returns on investments, staying the course is essential. Even small amounts add up over time into something substantial.

A financial planner can help you on this journey. Be sure to research their recommendations thoroughly before committing to any particular course of action.