Education is a long-term investment, and it can be expensive. Many students face additional expenses such as textbooks, lab fees, transportation, supplies, and technology. The cost of dorms, food, and other off-campus living needs should also be considered for those enrolled in higher education institutions.

These secondary expenses can add up quickly and can put a strain on students’ finances, as well as their families. This forces them to seek additional advance money from Paydaysay app or from family. But the worst thing is that we shouldn’t forget about student loans, which also negatively impact the financial situation. But there is a way out.

Even if you’ve already consolidated your student loans, you might still be allowed to do so.

If you have federal loans, student loan consolidation enables you to consolidate many federal loans into a single loan while maintaining the borrower protections and payment alternatives that federal loans enjoy. It can alter your term and loan servicer but won’t lower your interest rate.

Student loan consolidation is the term for the consolidation procedure if you have private student debts. In contrast to government consolidation, personal student loan consolidation allows you to change the loan duration and business and lower your interest rate. Federal and private loans can be combined with student loan consolidation, which is always done via a personal business.

Multiple Consolidating of Student Loans

Federal and private student loans can be consolidated with a private lender to obtain a lower fixed interest rate or better loan conditions. There is no restriction on how many times you can consolidate student loans.

Smart student loan customers consistently consolidate to benefit from loans with competitive variable interest rates. You can keep consolidating as long as you meet the requirements to receive the best terms for paying down your student loan debt or use money borrowing apps – try it out as additional money source.

Depending on the lender, you might be able to consolidate your student loans if you have the following:

- A credit report without errors.

- A rating of credit in the upper 600s.

- Enough money to pay for living costs as well as student loan repayments.

If you can’t get a consolidating on your own, think about getting one with a cosigner. Make sure, however, that you are aware of the conditions for a cosigner release before proceeding.

Remember that when federal loans are consolidated with a private lender, they lose their safeguards and eligibility for debt forgiveness programs.

What Kind of Loans Are Consolidable?

You can consolidate any federal student loan. Even a single loan may be consolidated. Consolidating a consolidation loan is nevertheless subject to a few limitations.

Only one consolidation loan can be used for borrowing. Loans that were not previously combined must be added to an existing consolidation loan to reconsolidate it. Additionally, you can combine two loan consolidations.

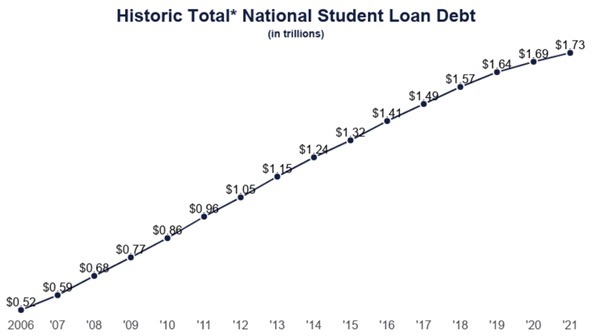

A consolidation loan cannot be combined with another loan, though. The national student loan debt amount decreased from 2022 Q1 to 2022 Q2, falling by 0.12%, which is 106% less than the average quarterly change since the first quarter of 2006.

Reconsolidating a loan does not relock the interest rates on loan, it should be noted. Within the meaning of the weighted average interest rate methodology used to determine the interest rate on the new consolidation loan, the consolidation loan is regarded as a fixed-rate loan.

Refinancing and Consolidating Student Loans Have Differences

There are significant distinctions between refinancing student loans and the Direct Consolidation Loan program that you should consider before making a choice. The Direct Consolidation Loan program allows you to combine all your student loans into a single loan and make a single monthly payment.

Refinancing, often known as private student loan consolidation, is largely for personal loans and is only available through private banks, credit unions, or internet lenders. If you have loans from both public and private programs and wish to combine them all, you must work with a private lender.

Refinancing and Direct Loan Consolidation vary primarily in that when you refinance. You negotiate a fixed or variable interest rate that is likely to be lower than what you were paying for each loan separately. Your credit score and whether you have a cosigner are factors considered by lenders when calculating your interest rate.

However, if you refinance federal loans, you give up the repayment options and programs that deferral and forbearance offer. If you have trouble paying back your debts because of financial problems, those latter two factors could be quite crucial.

What You Must Do to Consolidate Federal Student Loans

The Federal Student Aid website offers online application options for borrowers, who can download and print a paper application to ship to their preferred consolidation servicer.

Be ready to add financial information such as account statements, invoices, and records of college loans, as well as personal data like a phone number and email. Your FSA ID must be authenticated.

Additionally, you’ll be asked to choose a repayment schedule and specify which debts you wish to combine. If any of the loans you want to consolidate are now in a grace period, the processing of your application can be delayed. The total amount of student loan debt in the US is $1.745 trillion. Recent analytics show that most customers appropriately handle their student loan debt, and the rate of debt creation is slowing.

The Department of Education reports that the free form may be completed on average in 30 minutes or less. Borrowers will only have one monthly payment following the consolidation.

The submission has a timestamp. Borrowers will still be eligible for the limited waiver as long as they submit it by October 31, even if it is processed beyond that date.

The Advantages of a Second Consolidation

A Longer Time to Repay

Consolidating will lengthen the term of your loan if you require lower monthly payments to maintain budget stability. Under the Standard, Extended, and Graduated Payback Plans, your monthly payments will be smaller due to the longer repayment time.

A Simple Monthly Payment

You can consolidate your debts to make one loan that includes all of your federal loans. Borrowers with various loan kinds or services may find this to be of particular use. However, combining Parent PLUS Loans with other non-PLUS Loans should be done with caution. Aside from income-contingent repayment, most income-driven repayment programs will be ineligible for you if you do this.

Get Access to New Advantages

In some circumstances, a second consolidation may make you eligible for a repayment plan based on your income and other opportunities for forgiveness.

Conclusion

Consolidation might be the best option if you have private student loans or wish to lower the interest rate on your federal student loans. You may consolidate as often as you’re eligible, each time with a reduced interest rate and monthly payment. Additionally, you can combine federal and private debts by consolidating previously merged loans and through personal student loan consolidation.