Trading With Trends is a highly enriched, immersive learning experience that encompasses a powerful trading toolset. The course covers both basic and advanced technical analysis techniques for stocks, options, futures, and forex. The average true range (ATR) is a technical indicator used in trading which measures the difference between the highest and lowest closing prices over a given period of time.

What Exactly Is The Average True Range?

The average true range is a technical indicator known as the moving average of the highest and lowest price over a given time period. It is usually calculated using closing prices and also excludes weekends, holidays, and other market-trading days. The ATR is designed for looking at historical price movements, which can be used to gauge future trading trends. In simple terms what is atr? It is the average of daily high- low price movement from open to close.

What Does The ATR Indicator Measure?

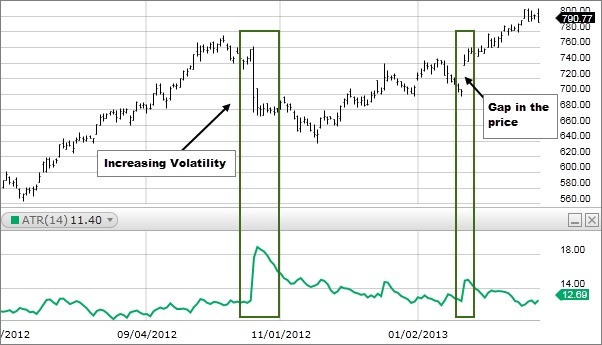

The true range is a volatility measure of the price movement over a given period. It is always reported as an absolute number so it may be positive or negative. The higher the ATR, the more volatile the price action. Analysts can use this information to determine whether support and resistance areas have been breached on high volume or if new trading ranges have emerged which could offer trading opportunities.

What Is The ATR Used For?

The average true range indicator can be used to predict impending price movements. When the ATR is trending higher, it suggests that the price is trending higher. When the ATR is trending lower, it suggests that the price is trending lower. A technical trader may look to take a long position when the average true range (ATR) indicator rises above its 20-day moving average and then closes above it on high volume. They may also look to take a short position if the ATR indicator falls below its 20-day moving average and then closes below it on high volume.

How Is The ATR Calculated?

The ATR is calculated by taking the true range (high – low) for a specific period of time and dividing it by the number of periods in that time period. As an example, assume that you have a daily true range of $1. If there are 100 days in a year, then the average true range would be 1/100th or 0.01. For example, if you bought one share of stock on 1/1/1998 (at $100.00), sold that share on 7/28/1998 (at $100.00), and then bought another share on 6/25/2000 (at $50.00), the average true range would be ($999.50 x 2)/(2 days x 2) = ($1024.75)/($26) = $65.31 .

How Is The ATR Used In Forecasting?

There are many ways that the average true range is used to forecast future price movements. One way is to look for areas of support and resistance that occur near key levels ($0, $100, $200, etc.) and see if those levels are being breached with high volume. Another method is to combine the average true range with another indicator such as relative strength (RSI). A third method is to simply watch how the average true range indicator moves over time after a buy or sell signal has been given.

What Is The Difference Between ATR And RSI?

The average true range (ATR) is a volatility indicator that measures the amount of price fluctuation over a certain period. The relative strength index (RSI) is another volatility indicator which measures the velocity and magnitude of price movement over a certain period. Both are extremely useful in determining the likelihood of an upward or downward price movement after a given signal has occurred.

Are There Other Uses For The ATR?

The average true range indicator can be used for a variety of different technical analysis techniques. One method is to compare it to the moving average convergence divergence (MACD). Another method is to look for bullish and bearish divergences. These divergences tend to suggest a potential price reversal ahead.

ATR and Blockchain

The average true range (ATR) indicator can be used to determine levels of volatility in the price of blockchain technology. If the ATR is able to stay above the 20-day moving average consistently, it suggests that investor confidence in blockchain remains high. If the ATR is consistently below the 20-day moving average, it suggests that overall market confidence in blockchain has gone into a negative mode. This would signal that trading in blockchain is beginning to retreat and could even result in a price movement of more than 20% in a single day.

ATR and Cryptocurrencies

The average true range indicator can be used for viewing cryptocurrency prices. Since cryptocurrencies may be trading at much higher volumes than traditional markets, the ATR is able to identify sharp price movements with higher frequency. This would indicate that when sentiment turns around, that sentiment will have a significant impact on market movements. In other words, investors who are comfortable with a small trading range for a given cryptocurrency may still have the ability to make significant gains on the way up and on the way down.

What Does The ATR Tell Us in Blockchain?

The average true range indicator can be used to alert investors that a move in the price of blockchain technology is likely to occur. For the ATR to be able to predict future price movements, there has to be a relatively high amount of volatility. If the ATR is consistently above the 20-day moving average, it is an indication that there will be increased volatility in price movements. Similarly, suppose the ATR is consistently below the 20-day moving average. In that case, it is an indication that price movements will stay within a smaller range and may not bring about an opportunity for profit.

In conclusion, what is atr indicator, and how to use the ATR in forex trading? The ATR indicator is a technical indicator that allows traders to gauge the volatility of a price. Using the average true range indicator as a forex trading strategy allows traders to get an idea of price movements over specific periods.